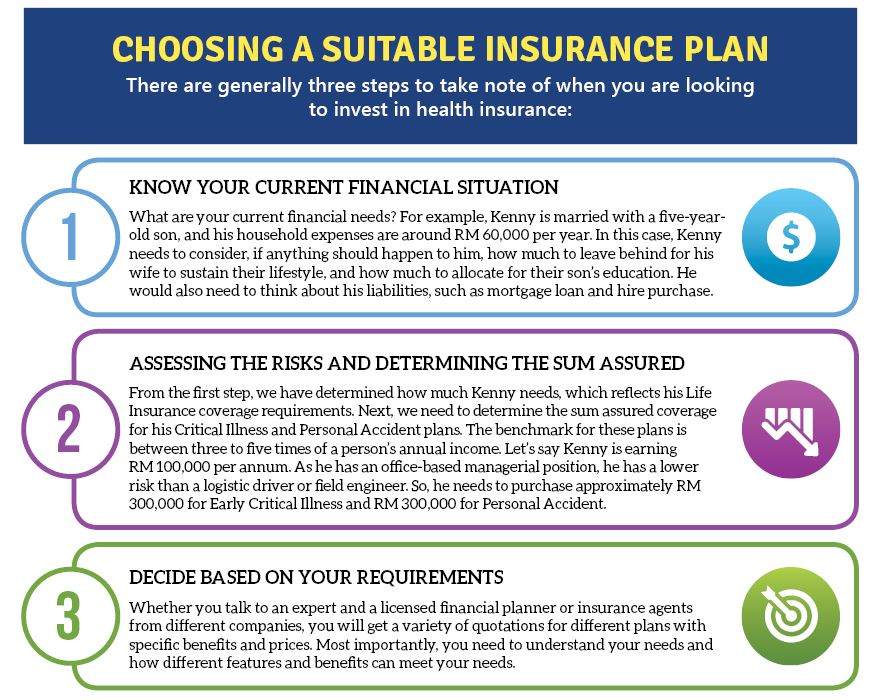

Selecting the right health insurance can be a complicated process, especially if you have no idea what you need or want. In this article, Annie Wong, Managing Director of Annieway 96 Sdn Bhd, a professional financial planning consultancy, shares her insight on how to make the right choice and what you should know before you decide on a policy.

When we talk about personal health insurance, there are many things to take into consideration. As it is a long-term investment, it makes sense to take your time and carefully choose one that suits you best.

In general, we can choose between four main types of insurance: life, medical, critical illness and personal accident. Each of these plans plays a role in protecting our income loss or helping us to mitigate high medical bills when we encounter an unfortunate event. Besides providing us with assistance in terms of expenses due to accidents or illnesses, insurance plans can also structure in a way to help us accumulate our wealth through contingency planning.

For example, during the recent pandemic, many business owners were afflicted with cash flow problems. For those with insurance plans, they can are able to obtain cash withdrawal from their savings in insurance policies while keeping the policies enforced. Unfortunately, for those who didn’t have a safety net in the form of a policy or other means of income protection, they either had to declare bankruptcy or go into serious debt to keep their businesses afloat.

Insurance is also beneficial when it comes to family succession planning. To date, there are close to RM 70 billion unclaimed estates from deceased Malaysian citizens. In these cases, estate distribution processes can’t be activated just because family members did not have not enough cash to kick-start the process. This eventually leaves all their family members properties, lands, and other assets frozen and kept under the government’s unclaimed estate department. On the contrary, with proper succession planning, life insurance can often provide an immediate lump sum of money.

Other Factors to Consider

The cost of insurance and premium allocation is also important when comparing insurance plans. Some companies will have frequent price adjustments, while some plans in the market allocate a smaller portion to the agent’s commission. Nevertheless, all this will benefit the insured (who bought the policy) because it helps to raise the savings portion in a faster period of time.

To take it a step further, you can also personally investigate the company’s cash flow background, payout history and reputation. Some companies have poor records of insurance claims, which may be due to the cash flow situation of a company, or the company is not operating onshore. This means that it takes a longer time when it comes to the claims procedure.